Breadth and Depth

The Swiss Army Knife of KPI Frameworks

Introduction

What if I told you there’s a simple, mathematically sound framework to derive new business metrics—one you can apply with just a bit of algebra? This tool has become the cornerstone of the analytical toolkit I’ve built over the 12 years I’ve been a professional business analyst. Over its seven years of application, it’s evolved from an intuitive approach to a guiding principle that spread among my colleagues. By rethinking how we measure success, we can unlock new paths for product evaluation and strategy. Let’s dive into the origin story of Breadth and Depth.

The Problem: Expectations vs. Reality

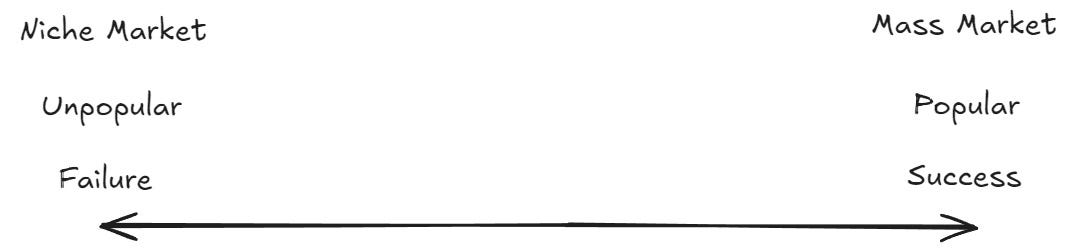

It all began when I worked with a team developing a creative product intended to have mass market appeal. But initial testing was showing a different direction. While the team thought they were making a product for everyone, the early feedback suggested it was more of a niche product, creating a mounting tension. Despite having nicer language, to the team, "mass market" meant success, and "niche market" meant failure.

Enter our protagonist. I was brought in as an internal consultant to use data and analytics to help understand the team and product challenges, explore new directions, and recommend solutions. My first move was to understand the team’s perspective by interviewing the team lead. What surprised me was how the crux of the issue felt more like a communication problem rather than purely a product problem. The tension highlighted a fundamental issue: the team perceived that early tests were evaluating their product on a single dimension—popularity—without the fully nuanced understanding of audience engagement.

To build our foundation, imagine the tension as a string being pulled in two directions—mass market appeal on one side and niche appeal on the other. This tension reflects the team’s struggle, caught between a desire for broad success and the reality of niche feedback.

When we put it this way, going from Niche Market to Unpopular is where the disconnect happens but in the absence of an alternative being “not Mass Market” leaves failure as the only option. But we can work with this since popularity can be measured by sales volume but be creative to find an analog in your application lens.

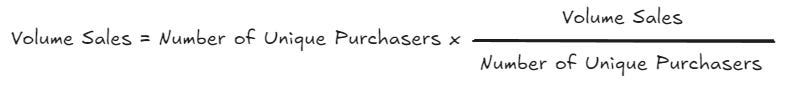

This translation gives us a numeric direction which is a good signal for an evaluation paradigm. However, it is still insufficient. Now we can do some math, though don’t get too excited, it’s not that complicated. In fact, it’s almost offensively trivial.

Why add this new information when it just cancels out? We often see simple multipliers in business metrics: Total App Engagement equals Unique Users multiplied by Average Session Duration, or Total Revenue as Volume Sales multiplied by Average Price per Sale. This straightforward breakdown mirrors the Breadth and Depth framework: a two-dimensional evaluation that goes beyond surface-level metrics and is useful in a variety of business applications.

Another reason is because we need some missing information, our initial definitions of Niche vs Mass Market. From that interview I conducted, the idea of “broad vs niche appeal” came up and the descriptions of those ideas are essential.

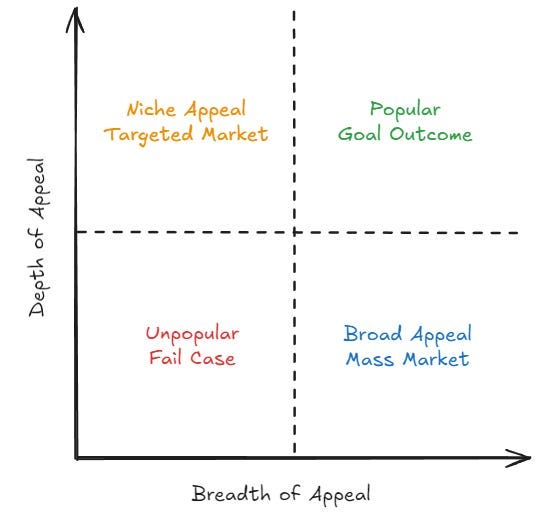

Broad Appeal: A lot of different people will be interested in at least trying, but may not repeatedly purchase, due to the variety of features and a more generically appealing aesthetic.

Niche Appeal: A small number of people will try but those who do will definitely do so repeatedly due to the specific or unique product market fit.

With this lens, we can reframe our trivial math breakdown and reveal the namesake of this article.

The Framework: Breadth and Depth

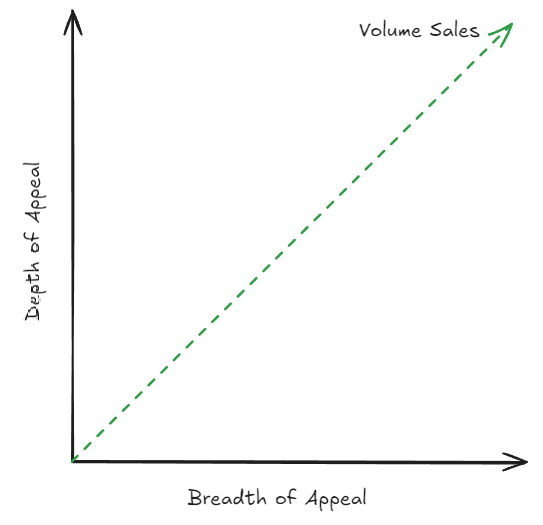

Breadth refers to the 'width' of a product’s appeal, capturing how many people might be interested, regardless of ongoing engagement. Depth measures the 'intensity' of appeal, indicating repeated engagement from the product audience. Together, they form a two-dimensional approach that provides a fuller picture of a product’s potential, revealing distinct paths to success beyond the binary labels of 'popular' or 'unpopular'

Put formally:

The superpower of this simple framework is that we unlock the power of the second dimension!

The Result: Two Paths to Success

With this perspective we can frame the product evaluation in a new way that allows for multiple kinds of products and unique definitions of success that prevent conflating Niche with Unpopular and Broad with Popular.

By categorizing feedback into Breadth (how many are interested) and Depth (how many are committed), the team could see that a product wasn’t failing—it was excelling within a niche market. This reframed feedback from a failure to a targeted opportunity

Wrapping Up: A Swiss Army Tool

So what happened next? Over time, past and future products were evaluated on this same framework which enabled even more novel analyses and improvements such as:

Cross product portfolio tracking: diversifying products across Broad and Niche markets reduces risk and avoids potentially competing with other similarly shaped products.

Trends and patterns by category: which product features tend to result in categorizations and applying those findings to future product strategy.

Adopting the Breadth and Depth framework allows teams to view feedback as a spectrum of opportunities rather than a judgment of success or failure. This shift dissolves tension, encourages strategic diversity, and fosters collaboration. If we had kept our one-dimensional mindset we would have missed out on an opportunity. It really makes me wonder how many other potential success stories have gone overlooked and are just waiting to realize their potential.

So, whether you’re aiming for broad appeal or deep engagement, recognizing the value in both dimensions empowers you to define success on your terms. This is why Breadth and Depth is a Swiss Army tool for navigating the complexities of product evaluation and I suspect you’ll agree.

David Novati | NovaAsterix

Post Credits Scene:

Astute readers may have mapped the notion of Breadth x Depth to other general contexts. My favorite is Frequency x Magnitude but more on that another time. I’d love to hear feedback and stories so share any success or attempted success, it’s the best way we can all learn together.

Nice read. I love how simple and versatile this breadth vs depth decomposition is. I feel like pretty much any metric can be broken apart and further analyzed this way.